from CharityDeductions.com where your donations are worth more than you think!

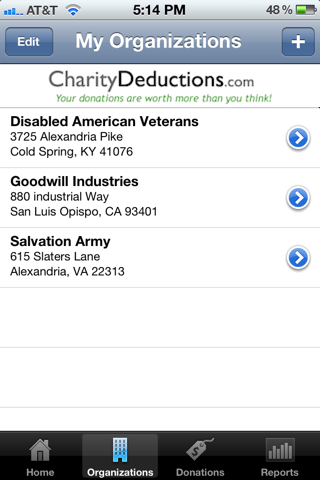

Track your charitable donations by entering your own item values, money, and mileage donations. You can then email a neat report detailing all your donations.

****This basic account allows you to try our eBay database of values up to a total of $500. To continue using the eBay database of values beyond the limit, you can upgrade to a Premium membership with an in-app purchase.****

Find accurate values for used items donated to charity and boost your charitable tax deduction. Most of our customers save $200 or more in taxes by itemizing their donations and using our eBay database of values. Protect yourself with the documentation that the IRS wants to see!

Highlights include …

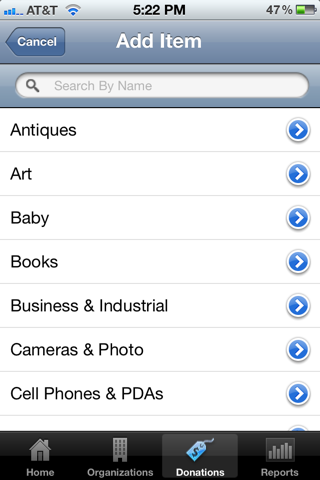

• Track item, cash, and mileage donations to charities

• eBay® database of 100,000+ values for new and used items (successful auctions)

- Find the items you donated, not just a small list of clothes and household goods

- Create your own custom item values if you want

• Choose from 5 condition levels and values to maximize your charitable deduction

• Tax savings calculator with running total as you add entries

• Automatically sync with your CharityDeductions.com account

• Store photos of your donations for tax and audit documentation

• PDF reports to send to your tax professional or print for your files

- Too much of a hassle to research the value of each item? We’ve done all the work for you! This is like having Blue Book values for used stuff!

- Nervous about guessing at the values? Most guesses are way too low leaving money on the table. Claim the correct value with confidence.

- Nervous about getting audited? We are as well, but know that IRS auditors have reviewed…and accepted…our valuation method in real audits!

ABOUT US:

* CharityDeductions.com™ began in 2003 as the first web-based valuation software for charitable donations.

* Licensed eBay® Market Data provider of completed successful auction values

* Featured in ABCs Good Morning America, the WSJ Sunday, and the Pacific Coast Business Times